As climate change continues to cause more distress to public life and mass blackouts and power outages become increasingly common, businesses are turning to solar combined with energy storage solutions to combat some of the problems with our traditional power grid system. But as building owners and investors study the ROI of a backup battery system for their solar energy, they’re often left wondering, “How do I assign a dollar value to the resilience benefit these energy storage systems provide?“

Resilience refers to the energy storage system’s ability to act as an island, operating independently from the grid in the event of a power outage. This adds incredible value to an energy storage system, especially during severe weather like hurricanes, when medical services, gas, groceries, and other essentials are in high demand. It allows hospitals and emergency shelters to continue operation, and it can even prevent loss of life.

Aside from resiliency, energy storage has tons of additional benefits. It provides opportunities for job creation, cost savings, safety, and reliability. It also creates environmental benefits by alleviating dependence on fossil fuels in favor of renewables like wind and solar.

While it’s fairly straightforward to assign a dollar value on the expected utility bill savings from investing in solar + storage, it’s more difficult to calculate the dollar value of resiliency.

Calculating avoided losses

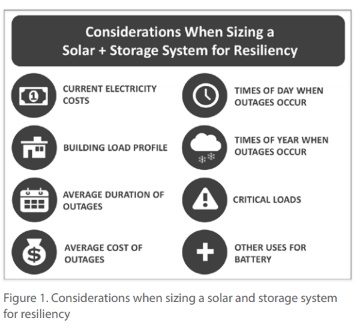

Fortunately, the National Renewable Energy Laboratory (NREL) , a national lab of the U.S. Department of Energy, has devised a system that places a value on grid resilience investments. In a recent NREL study, the value of resilience is calculated by using the avoided cost of an outage.

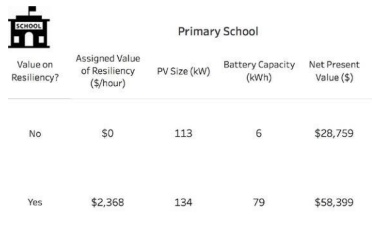

In this study , NREL incorporated the avoided cost of a grid outage into the financial planning and energy storage system sizing for buildings in Anaheim, CA. For each of the building types analyzed, two paths were investigated—one that assigns zero value to resilience, and one that assigns value to resilience in terms of dollars lost per hour of outage.

The study included the benefits of utility bill savings during normal grid operation combined with the benefits of running during outages.

Using a primary school as an example, NREL determined that the installation of a solar + storage system is the optimal choice, with reduced bills from lowered demand charges and energy expenses that strongly off-set the lifetime cost of the system. And that’s before factoring in the cost of savings from grid outages —which more than doubled the net benefit of choosing to install a PV and energy storage system.

NREL also found similar net benefits when considering solar plus energy storage for both a large office and a large hotel. When valuing resilience, the PV and energy storage system combination became the most economical option for the hotel over time, whereas neither PV nor storage alone would be economical otherwise.

Ultimately, this study highlights the fact that a bigger net needs to be cast when determining the cost-benefit of a PV and storage system. By attributing a value to grid downtime, you get a much clearer picture of an energy storage system’s true impact and the savings it could generate in the long run.

Dynapower solutions for PV + solar energy storage

At Dynapower, we’re proud to be at the forefront of the energy storage revolution. We’ve deployed more than 900MWs of energy storage solutions worldwide—including critical backup power for commercial and industrial facilities, fully independent microgrids, and fluid integration of solar and wind energy into the electric grid.

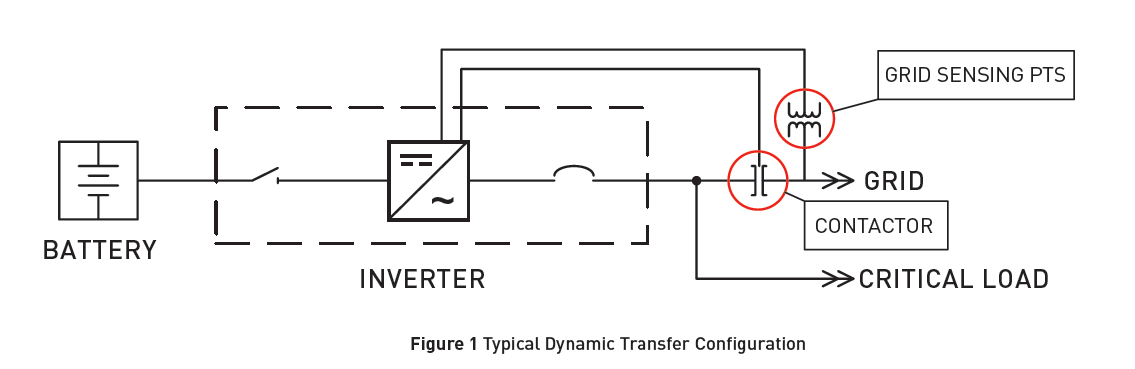

When it comes to grid resiliency and overcoming outages, Dynapower has developed and implemented its Dynamic Transfer™ technology to seamlessly transition from grid-tied operation to microgrid operation.

Our MPS®-i125 EHV behind-the-meter energy storage system is one of our products that implements Dynamic Transfer. These systems can be paralleled together to meet the sizing needs of any behind the meter installation and operate in both grid-tied and microgrid applications.

The frequency of climate-related outages and rising grid issues can be combated with a cost-effective energy storage solution. At Dynapower, we have the knowledge, capabilities, and expertise to spec, size, and build the right solution for your energy storage needs. Contact us today to get started.